Navigating CSDR Requirements and Double Materiality: Challenges and Opportunities

Share

The Central Securities Depositories Regulation (CSDR) and the concept of double materiality represent significant shifts in the regulatory landscape, each carrying unique challenges and opportunities for businesses.

Understanding CSDR Compliance

CSDR aims to enhance the safety and efficiency of securities settlement within the EU. Key elements include settlement discipline measures, reporting requirements, and operational changes to ensure timely trade settlements. For organizations, the main hurdles involve adapting internal processes and systems to meet these standards, while minimizing the risk of penalties.

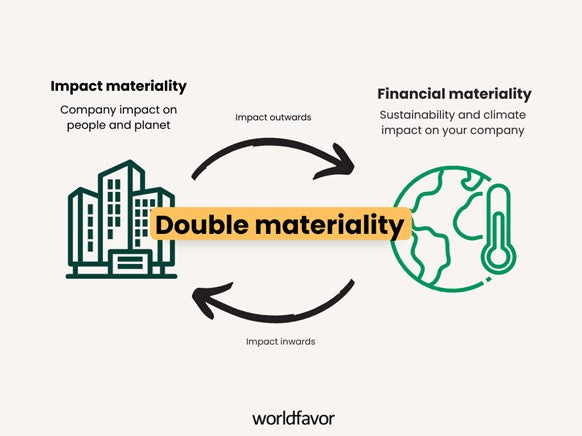

The Role of Double Materiality in ESG Reporting

Double materiality broadens the perspective of ESG reporting by considering not just financial impacts, but also environmental and social effects of business operations. Companies are expected to evaluate how sustainability factors affect their performance and how their activities impact broader societal goals. The European Financial Reporting Advisory Group (EFRAG) offers comprehensive guidance on this framework, helping entities align with evolving expectations.

Aligning Compliance and Sustainability Efforts

While the CSDR and double materiality address distinct areas, they share a common requirement: the integration of regulatory frameworks into actionable strategies. Organizations that proactively address these requirements will not only mitigate risks but also position themselves as leaders in governance and sustainability.

For more resources, consult EFRAG’s latest publications and explore best practices to align compliance and sustainability goals effectively.

QUICK USEFUL LINKS >>> https://www.efrag.org/en/sustainability-reporting